inheritance tax wisconsin rates

Keep reading for all the most recent estate and inheritance tax rates by state. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Tax Burden By State 2022 State And Local Taxes Tax Foundation

No estate tax or inheritance tax.

. State inheritance tax rates range from 1 up to 16. ESBT that has Wisconsin sourced income or. However the top graduated tax rate was reduced to 50 for 2002 with annual decreases of 1 thereafter through 2007.

Rate of tax see Tax rates. The graduated tax rates ranged from 18 to 55. Florida is a well-known state with no estate tax as well.

Key findings A federal estate tax ranging from 18 to 40. ESBT income is taxed at a rate of 765 percent. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992.

You can do it right here in Wisconsin. The top marginal rate was 46 for 2006 and is 45 for 2007 through 2009. California eliminated its inheritance tax as of January 1 2005.

56 million West Virginia. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

Investors should keep some limitations and. But some states do have these kinds of. State inheritance tax rates in 2021 2022.

Rule Tax Bulletin and Publication P AGO A A. INHERITANCE AND ESTATE TAX. The primary difference between estate.

GENERAL TOPICAL INDEX. But you dont have to go to Florida to avoid the state estate tax. No estate tax or inheritance tax.

Iowa Kentucky Nebraska and Pennsylvania. But currently Wisconsin has no inheritance tax. Currently only four states continue to impose inheritance taxes.

Brief history of the inheritance tax rates in wisconsin written by anonim published by anonim which was released on. Does Wisconsin Have an Inheritance Tax or an Estate Tax. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992.

There is no inheritance tax for deaths that occurred after January 1 1992 and. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Note that historical rates and tax laws may differ.

Burton answers the following question. The maximum credit is 1168. No estate tax or inheritance tax.

But really any property you own is subject to capital gains tax if you sell it for more than the original purchase price. A strong estate plan starts with life insurance. If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies.

Iowas estate tax was repealed in 2008. Learn Wisconsin tax rates for property sales tax and more to estimate how much you will pay on your 2021 taxes. As provided under EGTRAA all of the rates except those at the top remain the same as they were under prior law.

Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin. Washington DC District of Columbia. Download brief history of the inheritance tax rates in wisconsin books now.

To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions. Wisconsin Inheritance Tax Return. How is inheritance tax different from estate tax.

Not all states impose an inheritance tax in fact only a few states still do. The top estate tax rate is 16 percent exemption threshold. State Inheritance tax rate.

As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The state income tax rates range from 0 to 853 and the sales tax rate is 6.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. The District of Columbia moved in the. Theres a bond that pays a 962 interest rate and is guaranteed by the US.

Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

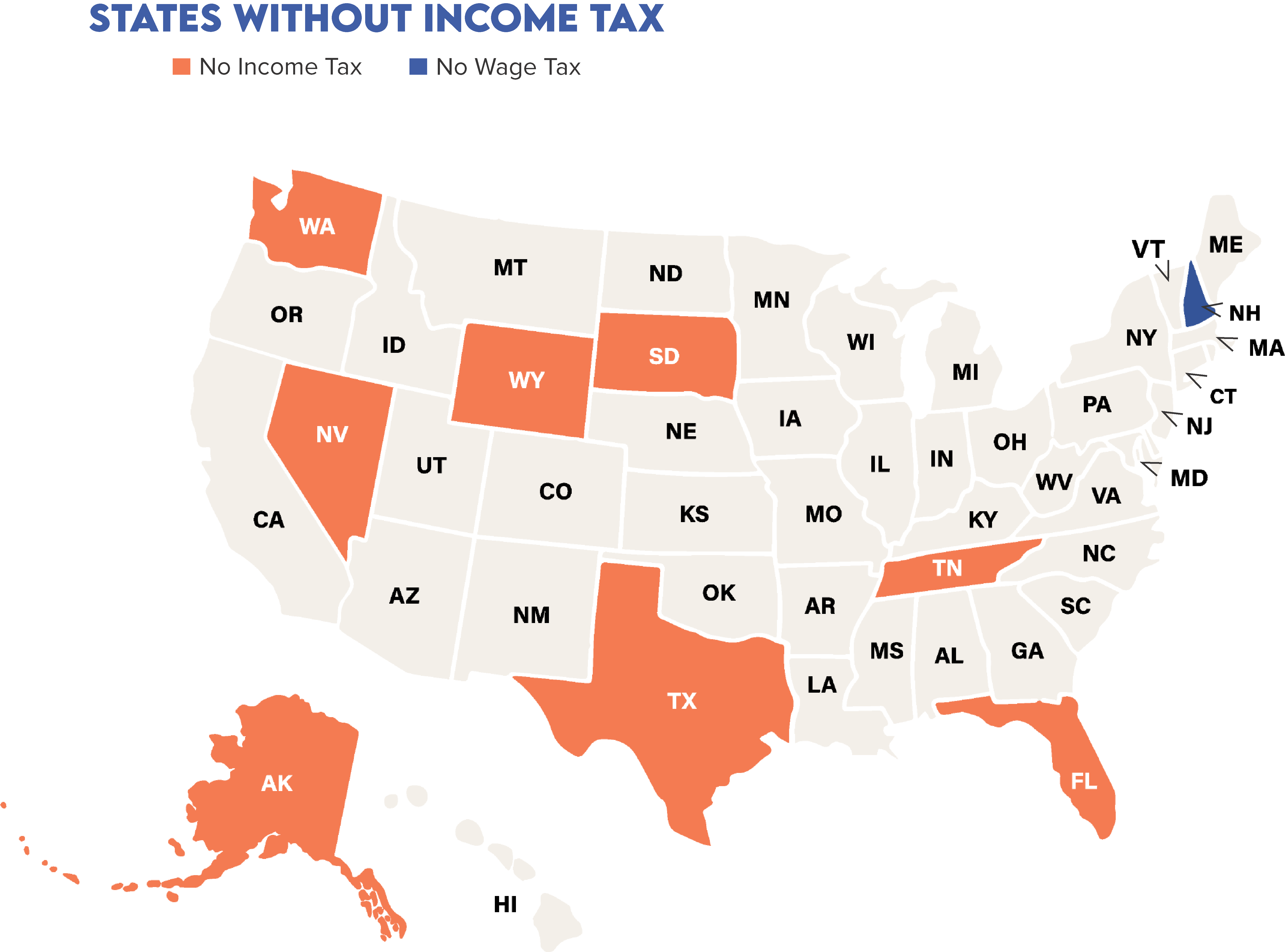

The Flight To Tax Free States Investor Tax Advantages

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

What Is The Estate Tax And How Does It Work Wisconsin Business Attorneys Wausau Eau Claire Green Bay

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Market Update Success Rate Mentor Coach Marketing

Pin On 2012 Elections Infographics

Wisconsin Inheritance Laws What You Should Know

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Pin On 2012 Elections Infographics

Wisconsin Inheritance Laws What You Should Know

Tax Information Village Of River Forest

Wisconsin Inheritance Laws What You Should Know

Property Tax Comparison By State For Cross State Businesses

Where Not To Die In 2022 The Greediest Death Tax States

States With No Estate Tax Or Inheritance Tax Plan Where You Die